Fintech App Development: Step by Step Guide to Build a Fintech Application

Sector: Digital Product

Author: Chintan Bhatt

Date Published: 01/07/2021

Contents

What is Fintech?

Fintech is the attractive new-age term for anything that has to do with technology and finance, right from software platforms for money transferring to Fintech App Development.

With time the Fintech Software Development Services is not only turning to be a trendsetter, but it has even allowed the financial sector to simplify the working for its consumers.

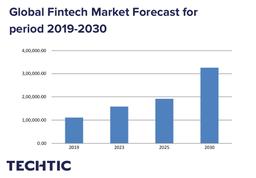

The global financial domain is predicted to be valued at US$ 26.5 trillion in 2022, with a CAGR of 6 percent. Also, according to the global fintech market research and analysis, the value of the fintech market reached a value of nearly $111,240.5 million in 2019, having grown at a CAGR of 7.9% since 2015, and is expected to grow at a CAGR of 9.2% to nearly $158,014.3 million by 2023. Also, the fintech market is likely to grow to US$ 191,840.2 million in 2025 at a CAGR of 10.2 percent and US$ 325,311.8 million in the year 2030 at a CAGR of 11.1 percent.

Step by Step Guide for Fintech Application Development

It might be challenging to follow the fintech app development process. Therefore, we have prepared the ultimate step-by-step guide for you for the fintech app development to build a successful that meets the expectations to achieve goals.

Here is the step-by-step guide for how to build a Fintech application.

1. Select the Precise Project Methodology

Hire an experienced project manager, a proficient architect, and business analysts with know-how in the FinTech industry. You require launching a “Minimum Viable Product” (MVP) and improve the application as per client-side and market feedbacks. Agile with iterative development is a more precise methodology than the Waterfall model for such projects.

2. Define the MVP Scope

As the best Fintech App Development Company, we recommend you define the MVP scope as below:

- Provide a web, an iOS, an Android app, a Microsoft Windows application, or a hybrid app.

- Include the functionalities and features of the newest mobile and web technologies.

- Prioritize these functionalities using advanced tools like Pain & gain map or prioritization matrix.

3. Pick an Efficient Development Approach

As a leading Fintech Mobile App Development Company, we recommend that you add the following building blocks in your development approach: Here are some tips you can follow, to develop a fintech mobile application.

- Utilize managed cloud services platforms intelligently, which will better enable IT infrastructure management

- Build native Android and iOS applications as they offer the best user experience

- Concentrate on application security as well as API security

- Use the latest tools, frameworks, and guidelines for the effective fintech development process

4. Create and Organize a Project Team

It is the right time to hire skilled Fintech app developers. You require to onboard the below roles to create an inclusive project team of:

- UI designers and web developers

- Android and iOS developers

- Testers

- DevOps engineers

5. Design and Create APIs

At this stage of fintech mobile app development, you need to design and create APIs to enable flawless and steady access to the backend from the front-end. We recommend that you make RESTful APIs, which involves the managed cloud services you have bought for precisely hosting the API backend. You can utilize database solutions such as MongoDB or PostgreSQL for building the APIs.

Read More: FinTech Trends to Watch in 2021

6. Plan to Safeguard the App and APIs

Here, secure your app and APIs utilizing techniques such as data encryption and authentication. Utilize authentication tokens, digital signatures, data encryption practices, throttling, quotas, and gateways to secure the APIs.

7. Develop the FinTech App

Many organizations have found that Progressive Web Apps PWA is a connecting bridge amid mobile web apps and native applications to be swifter and more fitting than traditional web apps. Utilize tools like Github, Ajax, CSS, ASP.Net, PHP, Python, JavaScript, and cloud software development services as they make fintech app development procedures useful and more straightforward. Further, integrate your APIs to create a fintech app.

8. Code, Test, and Deploy the App

Test your app, and deploy it. It will help if you design the UI for the Android application in line with the design guidelines. Code the Android application using Java, and apply Android Studio as the IDE. Integrate APIs in your code.

9. Launch the FinTech Application

Prepare launch activities, promote it on diverse platforms, identify key influencers, and develop a press kit. In the end, submit your mobile application to the app store(s).

Core Features Enabling Performance of FinTech Apps

Use of Fintech apps is much easier than dealing with traditional financial services. It benefits to overcome Fintech app development challenges, ways, from setting up easy payment Gateway integration to voice integration.

1. Enable Security

All the fintech applications must comply with security needs safeguarding users’ financial details. To accomplish this,a professional fintech app developer enables encryption, blockchain, biometric, and two-factor authentication and takes other security measures.

2. Payment Gateway Integration

Most of the fintech apps have to deal with payments. To facilitate the payment functionality, you may select to integrate with services such as PayPal, Stripe, Zelle, or work through bank APIs.

3. Dashboards

Build useful dashboards because dashboards are essential in the fintech app development stages. It’s tough to imagine for someone to build a fintech app without a visual representation, no matter it’s for financial spending, payments history, or any stock charts.

4. Voice Integration

Fintech apps need to offer modern features to customers like voice assistants, including Siri, Google Assistant, and Bixby. This is the best feature of Fintech mobile apps development.

Fintech apps need to offer modern features to customers like voice assistants, including Siri, Google Assistant, and Bixby. This is the best feature of Fintech mobile apps development.Read More: Features of Fintech App That Increase App Engagement

Other important features for the fintech app development process

- Precisely Working Login/Restoration Page

- Display of Transaction History/Online Passbook

- Facilitate Feedback System

- Social Media Integrations

- One-Click Contacting

- QR/Barcode Scanner Integration

- Usability of FinTech Apps in Offline Mode

Key Functionalities of a FinTech Application

- Making bill payments and successful money transfers simpler

- Precise checking of transactions’ history and enable transaction messages

- Enable push notifications, alerts, reports, and analytics

- Facilitate accessibility of Geo-location and currency conversion tools

Cost to Build a Fintech Application

The overall cost to develop a Fintech app depends on a mixture of factors. But our strategy and fintech application development team have calculated average pricing by research and previous experiences.

It would cost around $7,000 to $9,000 with committed professionals building your fintech app with a time frame of approximately 8,00 to 9,00 hours.

Wrapping Up

The rising use of digital payments, more investments in blockchain technology, the increasing maturity of eCommerce, and inference of COVID-19 are expected to steer the FinTech market further.

We are a leading Fintech Software Development Company, and you can readily hire a Fintech App Developers team through us for your upcoming technology projects.

Latest Tech Insights!

Join our newsletter for the latest updates, tips, and trends.