How Generative AI is Transforming the FinTech Industry

Sector: Digital Product

Author: Nisarg Mehta

Date Published: 12/22/2023

Contents

- Introduction

- What is Generative AI?

- Statistics: Generative AI in the FinTech Market

- Revamping Customer Experiences

- Data Analytics and Predictive Modeling

- Automation and Efficiency: Generative AI's Role in Streamlining FinTech

- Ethical Considerations: The Tightrope Walk in AI's FinTech Adventure

- Challenges and Future Directions: Charting the Course for AI in FinTech

- Revolutionize Your FinTech Organization with Techtic

Introduction

Welcome to the exciting world of technology, where artificial intelligence (AI) isn’t just changing the game – it’s completely rewriting the rulebook! Right at the heart of this technological whirlwind is Generative AI. Think of it as a creative genius in the AI family, with an incredible knack for producing content, data, and even stunning art pieces. And guess where it’s making a huge splash? That’s right, the FinTech industry!

Generative AI is like a superhero in FinTech, breaking barriers we didn’t even know existed. Imagine a world where financial services are not just provided but are tailor-made for you, where your bank understands your needs before you even spell them out.

From making risk assessments as easy as pie to revolutionizing customer service, from the thrill of algorithmic trading to the precision of credit scoring and the Sherlock-Holmes-like skills in fraud detection, Generative AI is turning the financial sector into a sleek, secure, and super-user-friendly universe.

In this blog, let’s strap in and take a whirlwind tour through the wonders of Generative AI and see how it’s transforming the FinTech industry from the inside out. Ready? Let’s dive in!

What is Generative AI?

Generative AI is like the Swiss Army knife of the tech world – a branch of artificial intelligence that’s all about getting machines to mimic human creativity. It’s not just about churning out content; it’s about teaching machines to think, act, and even create like us humans. This tech whiz can make sense of patterns, learn on the go, and whip up something new, which is super handy when it comes to building FinTech applications.

Now, don’t let the “under development” tag fool you. This AI prodigy is already out there, flexing its muscles across various sectors. It’s like the new kid on the block who’s already a star, revolutionizing how we develop products and services. Stay tuned, because Generative AI is gearing up to turn our everyday lives into something straight out of a sci-fi movie!

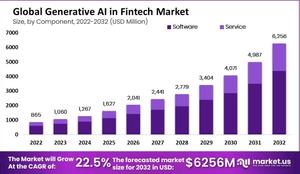

Statistics: Generative AI in the FinTech Market

Source: market.us

The market is on a skyrocketing journey, projected to balloon at an impressive CAGR of 22.5% between 2023 and 2032. By the end of this exhilarating ride, we’re looking at a whopping market size of $6.256 billion in 2032. So, what’s fueling this incredible growth? Let’s break it down:

- FinTech companies are jumping on the Generative AI bandwagon big time. They’re using it to rev up their operational engines, trim down costs, and whip up exciting new products and services.

- Digital banking and mobile payments aren’t just trends – they’re revolutions! This shift is creating a thirst for financial services that are not just smart but also have a personal touch.

- Data and computing resources are becoming more accessible. This means Generative AI models are getting smarter, sharper, and more sophisticated.

This surge paints a clear picture: the financial industry isn’t just flirting with the idea of Generative AI, it’s getting serious about it. Leading financial institutions are already rolling out some cool initiatives, showcasing the potential of this tech marvel.

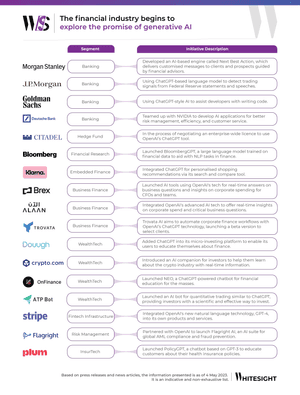

The following infographics show that the financial industry is beginning to explore the promise of generative AI.

Source: whitesight.net

These glimpses into the financial world are just the tip of the iceberg when it comes to Generative AI’s role in finance. As this tech continues to evolve and flex its muscles, we’re in for an exciting show of innovation and transformation. Think of it as a magic show where the tricks keep getting more jaw-dropping.

The financial industry is just warming up, and in the coming years, we’re likely to witness some truly groundbreaking applications of Generative AI. So, keep your eyes peeled – the best is yet to come!

Now, let’s dive deep into how Generative AI can help banking and financial institutions.

Revamping Customer Experiences

Generative AI is doing more than just sprucing up the FinTech industry’s back end; it’s totally revamping customer interactions with financial services.

A. Custom-Tailored Financial Guidance

Here’s where Generative AI really shines in FinTech: dishing out super personalized financial advice.

Old-school financial advisory services are like one-size-fits-all t-shirts – they kind of fit everyone but don’t really suit anyone perfectly. Generative AI, on the other hand, is like your personal financial stylist.

It dives into your financial wardrobe (a.k.a. data), measures your risk comfort, and checks out your investment goals to whip up investment strategies that fit you like a glove.

This isn’t just about making customers happy; it’s about helping them hit their financial targets with style and precision.

B. Chatbots and Virtual Assistants: Your 24/7 Financial Pals

Welcome to the age of instant everything!

In FinTech, chatbots and virtual assistants, powered by Generative AI, are the new MVPs. Imagine having a smart buddy who can answer your financial queries, update you on your account, or even make transactions on your behalf – all in a snap.

These AI pals are always on, making life easier for customers and slicing down operational costs for financial institutions. It’s like having a financial helper who never sleeps!

C. Sentiment Analysis: The Pulse Checker

Knowing what customers feel is gold in FinTech, and Generative AI is the ultimate pulse checker. It sifts through mountains of text – reviews, feedback, tweets – to get the scoop on what people think about financial products or services.

This isn’t just number-crunching; it’s like reading the mood of the room in real-time. Companies can quickly tune into customer vibes, tweak their services, and keep their clientele happier and more loyal.

D. The Fraud-Busting Superhero

In the twisty world of financial crime, Generative AI is the superhero we didn’t know we needed. It’s like a high-tech detective, constantly scanning transaction patterns to sniff out the fishy stuff.

Spot an odd transaction? Bam! Generative AI flags it. This not only shields customers from losing their hard-earned money but also cranks up their trust in transaction security.

Data Analytics and Predictive Modeling

Generative AI is not just changing the game; it’s rewriting the playbook in data analytics and predictive modeling in finance. Let’s dive into how it’s giving financial institutions some serious superpowers.

A. Risk Assessment and Credit Scoring: The AI Crystal Ball

Credit risk assessment is the heartbeat of FinTech operations. Generative AI is like a crystal ball, giving financial institutions a clearer, real-time picture of creditworthiness. It’s not just about looking at transaction histories anymore.

AI digs into everything – from your tweets to unconventional data – painting a fuller picture of credit risk. This means not only fewer bad loans but also opening doors for those previously locked out of the financial system.

B. Portfolio Management and Asset Allocation: The AI Financial Guru

For investors and asset managers, Generative AI is like a financial guru. It juggles a myriad of factors – economic trends, and global events – and adjusts portfolios on the fly. The result? Sharper risk management, fatter returns, and smarter resource allocation. It’s like having a supercomputer for a financial advisor.

C. Market Forecasting and Trading Algorithms: The AI Trader

In trading, Generative AI is the new whiz kid. It munches on mountains of market data and makes trades in the blink of an eye. What’s more, it spots market trends and patterns that even the sharpest human traders might miss. For financial institutions, this means better returns and smoother sailing through market turbulence.

D. Regulatory Compliance and Reporting: The AI Watchdog

Navigating the labyrinth of financial regulations? Generative AI has got it covered. It automates the grunt work of monitoring and reporting transactions, keeping financial institutions in the clear with regulators. Think of it as a vigilant watchdog, ensuring that the complex web of compliance is handled smoothly, saving institutions from hefty fines and headaches.

Automation and Efficiency: Generative AI's Role in Streamlining FinTech

Generative AI is like a superhero for efficiency in the FinTech world. Let’s dive into how it’s revolutionizing processes, slashing costs, and automating the nitty-gritty.

A. Cutting Down Operational Costs: The AI Efficiency Expert

Operational costs in finance can be a real headache. Enter Generative AI, the efficiency expert. It’s taking over tasks that used to eat up time and resources, like data entry, document processing, and answering customer queries.

This AI isn’t just about cutting costs; it’s also about zapping errors that humans might make. Fewer people needed for routine jobs means more savings and smoother operations.

B. Smoothing Out Back-Office Operations: The AI Organizer

In the back office, where the magic of finance happens, Generative AI is the ultimate organizer. It takes on jobs like data reconciliation, keeping records in check, and ensuring compliance – all tasks that are crucial but, let’s be honest, not the most exciting.

With AI handling these, the human workforce can focus on the creative and complex stuff that machines just can’t match.

C. Smart Contracts: The AI Lawyer

Blockchain and smart contracts are like the new kids on the FinTech block. Generative AI steps in as the lawyer, crafting smart contracts for all sorts of financial deals – loans, insurance, you name it.

These AI-generated contracts do their thing automatically when conditions are met, cutting out the middleman, and saving time and money.

D. Streamlining Customer Onboarding and KYC: The AI Gatekeeper

Customer onboarding and KYC (Know Your Customer) are crucial but can be a drag. Generative AI to the rescue! It speeds up the whole process by automating identity checks and risk assessments. This means a faster, smoother ride for customers, all while keeping things on the up and up with regulations.

Ethical Considerations: The Tightrope Walk in AI's FinTech Adventure

While AI is like a tech genie granting wishes in FinTech, it’s not without its ethical tightropes that need some serious balancing.

A. Data Privacy and Security: The Digital Vault

Top of the list is keeping customer data safe. Think of financial institutions as digital vaults holding precious secrets. With Generative AI, the risk of data leaks jumps up a notch. It’s all about ironclad encryption, Fort Knox-style storage, and giving only the keyholders access to keep this data under lock and key.

B. Algorithmic Bias and Fairness: The Equalizer

Here’s a tricky one – AI learns from past data, which can be as biased as an old-school radio. This means AI might unintentionally favor or snub certain groups, especially in sensitive areas like loans or credit scores. Keeping AI fair is like being a referee; it needs constant monitoring, bias-busting techniques, and a strong commitment to playing fair with everyone.

C. Regulatory Challenges and Compliance: The Legal Maze

AI in FinTech is like a game where the rules keep changing. Navigating laws like GDPR or HIPAA turns financial institutions into legal acrobats, balancing the use of AI with a web of regulations. Staying on the right side of the law and ethical use is not just smart – it’s a must to avoid legal hot water.

D. Transparency and Accountability: The Clear Box

AI decisions can be as murky as a foggy night. In FinTech, where trust is everything, peeling back the layers of AI’s “black box” to make its decisions clear is crucial. It’s about showing your work, not just the final answer, to earn customer trust and tick regulatory boxes.

E. Job Displacement and Workforce Impact: The Human Factor

Efficiency is great, but what about the people? Automation could mean jobs changing or even disappearing. FinTech firms diving into AI should think about the human side, offering retraining or skill upgrades to keep their teams in the loop and in the game.

Challenges and Future Directions: Charting the Course for AI in FinTech

As we zoom into the future with generative AI in the FinTech sector, it’s not all smooth sailing. There are some choppy waters and uncharted territories ahead. Let’s navigate through these:

A. The Scale-Up Hurdle: Power and Data Demands

As generative AI gets more popular in FinTech, the spotlight turns to scaling up and resource needs. These AI models are like sports cars – they need lots of fuel (read: computational power) and a good road (big datasets) to run. This could be tough for the smaller players in FinTech, potentially leading to a David vs. Goliath scenario in the industry.

C. Melding AI with Old-School Finance

For the big, traditional finance institutions, blending generative AI with their old systems is like trying to fit a square peg in a round hole. It’s tricky and needs big bucks and the right talent. But if they don’t join the AI party, they risk falling behind in the race.

D. Bracing for Unexpected Twists

The FinTech world should buckle up for a ride full of surprises thanks to the rapid evolution of AI. Being ready for unforeseen shifts and challenges is crucial. After all, the finance sector is no stranger to storms, and staying afloat requires resilience and adaptability.

Revolutionize Your FinTech Organization with Techtic

In conclusion, FinTech is perched on the edge of a revolution, all thanks to generative AI. From reshaping customer experiences to tackling ethical questions, this journey is about collaboration, smart adaptation, and responsible AI development.

Ready to take your FinTech venture to new heights with generative AI? Look no further than Techtic! We’re all about blending innovative AI solutions with your unique needs, driving efficiency and satisfaction.

Get in touch with us, and let’s make AI work wonders for your business. Don’t just keep up with the competition – stay miles ahead with Techtic’s AI expertise!